2024 GS Pay Scale: Find Your Federal Employee Salary & Locality Pay!

Are you a federal employee wondering what your paycheck will look like in 2024? Understanding the General Schedule (GS) pay system is crucial for every white-collar federal employee, as it dictates your base salary and potential locality adjustments. Let's delve into the details of the 2024 GS pay scale, locality pay adjustments, and how to calculate your hourly and annual rates.

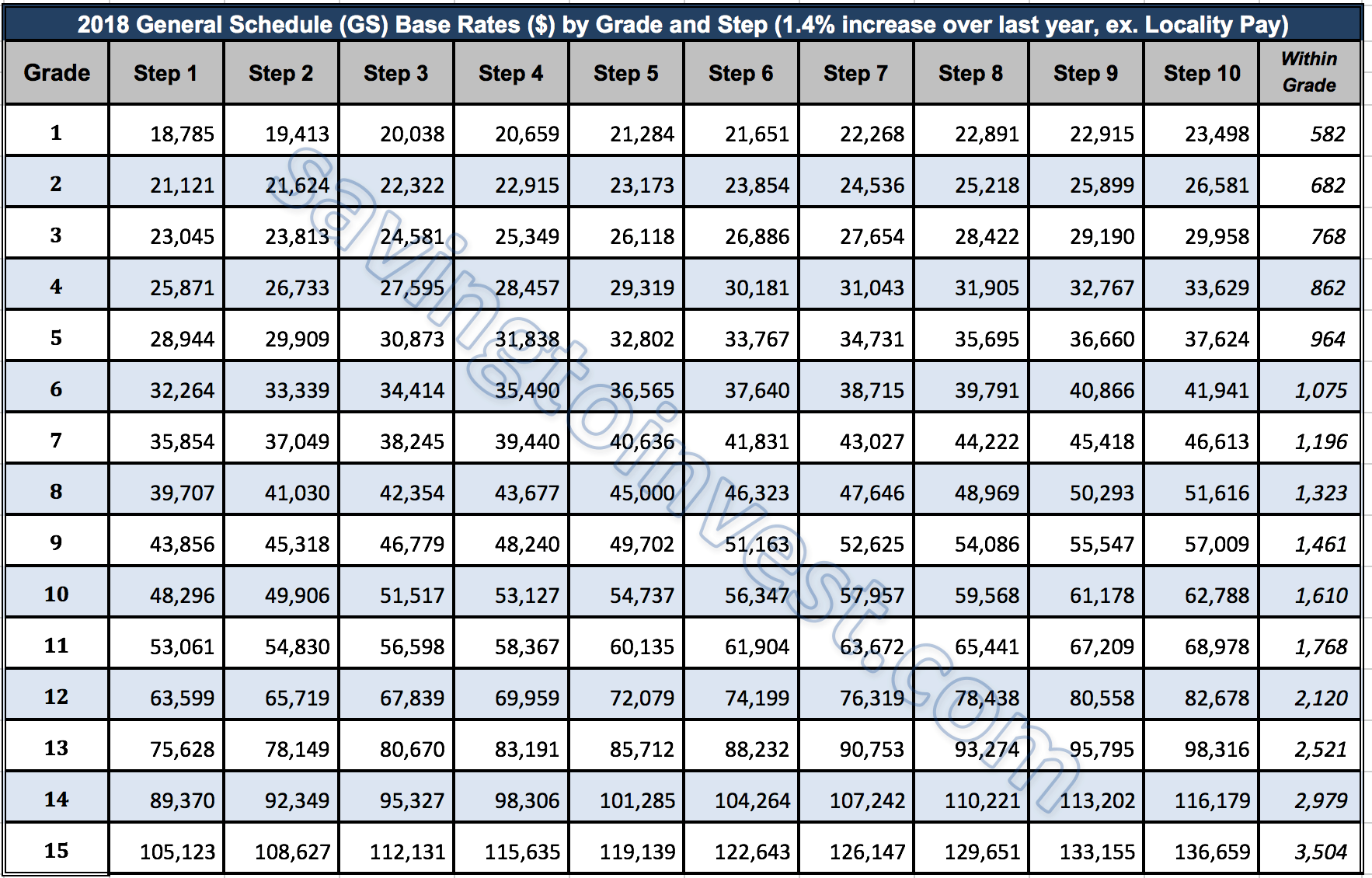

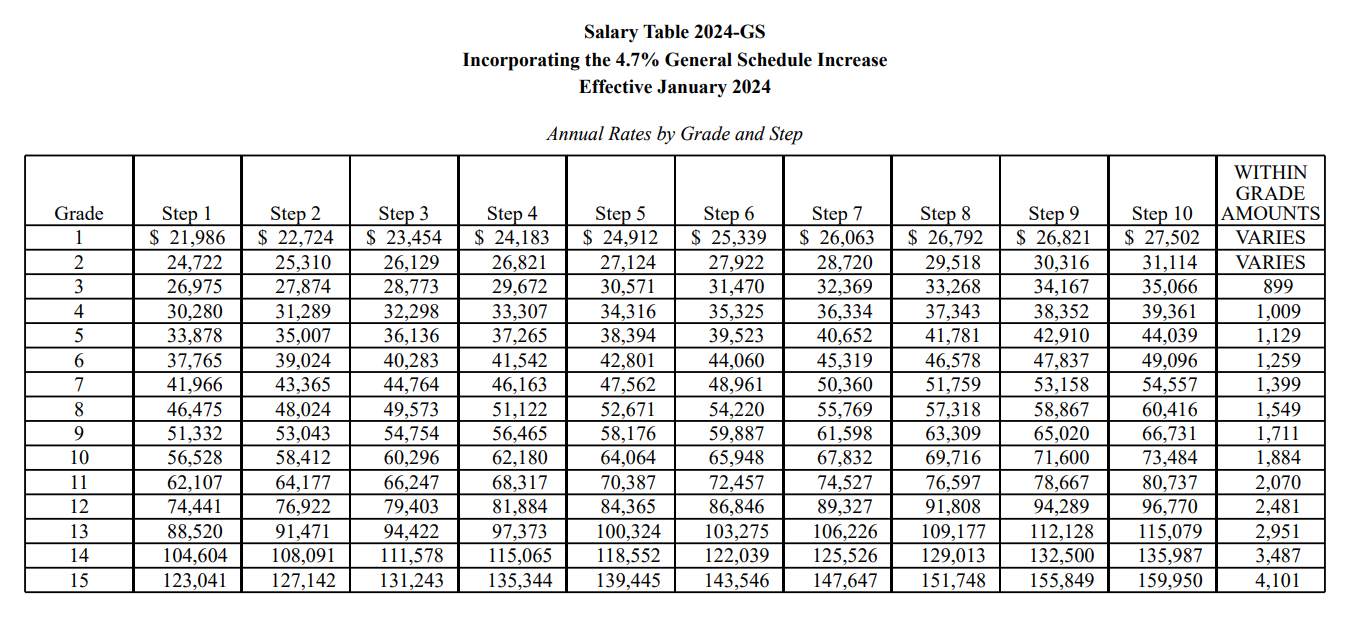

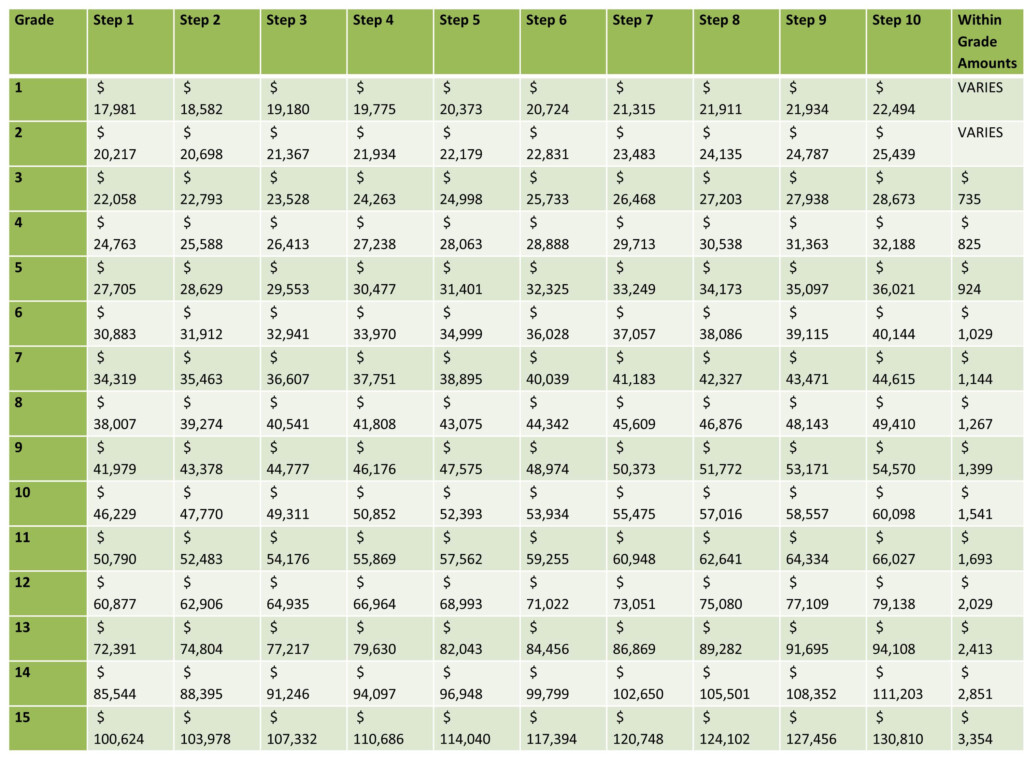

The General Schedule (GS) pay system, often referred to as the "civil service" pay system, establishes salary levels for federal employees in various white-collar positions. In January 2024, the GS pay scale underwent adjustments, reflecting an overall average pay increase of 5.2%. These adjustments encompass both a base pay increase and locality pay adjustments, aiming to address cost-of-living differences across various geographic areas. Federal employees in Newport News, for instance, are paid under the adjusted General Schedule pay table for the Virginia Beach GS locality, resulting in an 18.8% pay increase above the base GS pay rates. Its vital to consult both the base pay table and the locality pay tables specific to your region to get an accurate picture of your compensation.

| Category | Information |

|---|---|

| System Overview |

|

| Key Components (2024) |

|

| Locality Pay |

|

| Pay Rates (Examples - Hypothetical) |

|

| Important Dates & Updates |

|

| Resources |

|

The 2024 GS pay schedules became effective on the first day of the first applicable pay period on or after January 2024. To accurately determine your annual rate, you must first identify your GS grade and step. From there, consult the base pay table to find the corresponding base salary. However, the base salary is only part of the equation. Locality pay adjustments significantly impact your overall compensation, especially in areas with higher costs of living. For example, General Schedule employees working within a region may be paid a percentage more than the GS base pay rates to account for local cost of living.

- Jimmy Butler Kaitlin Nowak Kids Relationship Drama More

- Taurus Scorpio Friendship Compatibility Challenges More

Locality pay adjustments are implemented to ensure that government salaries remain competitive with comparable positions in the private sector within specific geographic areas. Without these adjustments, it would be challenging to attract and retain qualified federal employees in regions with high living expenses. In effect, locality pay acknowledges that the same salary may afford a vastly different standard of living depending on where an employee is stationed. For instance, employees working in a GS locality other than the "rest of U.S." are paid a higher locality pay adjustment based on the higher cost of living in their area.

The Office of Human Resources frequently receives questions regarding the GS pay system. Many employees seek clarity on how their specific locality pay is calculated and how it impacts their overall compensation. It's important to remember that locality pay is a percentage added to the base pay, and this percentage varies significantly across the country. For instance, the 2025 locality pay adjustment for some localities may be as high as 36.47%, meaning GS employees in that area are paid 36.47% more than the GS base pay table. Keep in mind that the 2025 locality adjustments are illustrative for future planning but not directly applicable to 2024 pay calculations.

To determine your hourly rate, you would typically divide your annual salary (including locality pay) by 2087, which represents the approximate number of working hours in a year for a full-time federal employee. However, it is crucial to consult official sources and your agency's human resources department for precise calculations, as factors such as overtime and other types of pay may influence the final figure. Its also important to remember that percentages increases of 5.44% and 4.99% are used to determine the annual rates by grade and step, which is then used to determine the hourly rate.

The GS pay scale consists of 15 grades, from GS-1 to GS-15, with each grade having 10 steps. Employees typically progress through the steps within their grade based on performance and time in service. The base pay for each step is outlined in the GS pay table, which is updated annually. Its important to note that the base pay represents the minimum salary for each grade and step, and the actual compensation can be significantly higher when locality pay is factored in. In addition to base pay and locality pay, federal employees may also be eligible for other types of pay, such as overtime, hazardous duty pay, and performance bonuses.

For those stationed in Tennessee, the General Schedule (GS) payscale is updated for year 2024. To accurately determine your pay, consult the 2024 GS and locality pay tables. These tables will provide the base rates, locality pay percentages, and charts for general schedule (GS) pay grades in 2024. These resources will help you find the annual rates by grade and step for the general schedule (GS) pay system effective January 2024.

Federal employees should be aware of potential pay increases, expansions, and special rates for different occupations and areas. The Office of Personnel Management (OPM) provides resources to help employees understand their full compensation. One such resource is the interactive pay calculator, which allows employees to input their GS grade, step, and location to estimate their salary. Another helpful tool is the locality map, which shows the locality pay areas across the country.

Furthermore, its crucial to understand the concept of Wage Grade Increases (WGI). The table for example, shows the base pay for each step and the WGI (locality pay) for WGI 1 and WGI 2. The WGI system applies to federal employees in trade, craft, and laboring occupations. These employees receive pay adjustments based on prevailing rates in their local area. Therefore, understanding the WGI system is essential for federal employees in these types of positions.

To navigate the complexities of the GS pay system, federal employees should proactively seek information and guidance from their agency's human resources department. HR professionals can provide personalized assistance and answer specific questions related to pay, benefits, and career advancement. Additionally, employees can utilize online resources, such as the OPM website, to access pay tables, calculators, and other relevant information. Staying informed about pay policies and procedures is crucial for federal employees to effectively manage their finances and plan for their future.

The GS pay system is subject to change, so it is important to stay up-to-date on the latest developments. OPM regularly issues guidance and updates on pay policies, and these updates can significantly impact federal employees' compensation. By staying informed and seeking clarification when needed, federal employees can ensure that they are being paid accurately and fairly. A focus area should be placed on if this section focuses on a question the office of human resources often receives. It is important to consult official sources and seek guidance from your agency's human resources department for accurate and personalized information about your pay and benefits.

In summary, understanding the General Schedule (GS) pay system is essential for federal employees. By consulting the base pay table, locality pay tables, and utilizing available resources, employees can accurately determine their annual and hourly rates. Staying informed about pay policies and procedures, seeking guidance from human resources, and proactively managing your career are crucial steps to maximizing your compensation and achieving your financial goals as a federal employee. The 2024 GS pay tables and locality adjustments represent a commitment to ensuring fair and competitive compensation for federal employees, recognizing their vital contributions to the nation.

While this information provides a general overview of the GS pay system, it is essential to consult official sources and seek guidance from your agency's human resources department for accurate and personalized information about your pay and benefits. Staying informed is key to navigating the complexities of the federal pay system and ensuring that you are compensated fairly for your service.

Navigating the intricacies of federal compensation requires constant vigilance, especially given the ever-changing economic landscape and localized cost-of-living adjustments. For instance, consider the implications of the 2025 locality pay adjustments which, while not directly applicable to 2024 calculations, offer a glimpse into future trends. A locality might see a boost of 20.35%, translating to a significant increase in the take-home pay for GS employees stationed there. However, remember that these are projections and real-world application may vary.

Therefore, federal employees should diligently monitor the pay tables, pay increases and special rates, and expansion offered to them for different occupations and areas. The ability to accurately calculate not only your base pay but also any additional locality adjustments will arm you with crucial knowledge in negotiating salary increases or evaluating job offers. Tools like the interactive pay calculator and locality map offered by OPM are indispensable assets in this process.

Understanding how locality pay affects your overall compensation is also vital. Newport News, for example, falls under the Virginia Beach GS locality, which provides an 18.8% pay increase above the base GS pay rates. This adjustment aims to address higher costs of living, helping to ensure that government salaries are competitive with comparable positions in the area.

Furthermore, employees working in Tennessee should consult the 2024 updated General Schedule (GS) payscale to ascertain their compensation. Staying on top of these region-specific adjustments can make a significant difference in your financial planning. If your base pay at GS-7, step 5 is $50,000 in a locality with a 18.8% locality pay adjustment, it amounts to $9,400 (18.8% of $50,000). Then, with your total annual pay being $59,400 and based on 2087 hours/year, your hourly rate would be $28.46.

Keep in mind that adjustments are used to account for higher costs of living and to keep government salaries competitive with comparable private sector salaries. This is why understanding the WGI (locality pay) for WGI 1 and WGI 2 is critical.

Finally, remember that the civil service pay system covers a broad range of federal employees. If you have any questions, contact the office of human resources, as they often receive questions and will have answers to your queries.

- Jimmy Butler Kaitlin Nowak Kids Relationship Drama More

- Bumpy Johnson The Real Story Behind Harlems Godfather

General Schedule Pay Scale 2025 With Locality Hudson Reed

GS Tables for Federal employees in 2024

2024 Gs Pay Scale With Locality Pay Nc Reggi Charisse