2025 GS Pay Scale: What's New? Find Your Federal Salary!

Is your federal paycheck keeping pace with the soaring cost of living? The stark reality is that for many dedicated government employees, particularly those in high-cost areas, the answer is a resounding no. The persistent gaps in pay, especially in cities like San Francisco, New York, and Seattle, where locality pay already sits at the highest tier, paint a concerning picture of economic disparity within the federal workforce.

The complexities of the General Schedule (GS) pay scale, which governs the salaries of over 70% of federal government employees, continue to be a source of both fascination and frustration. Understanding how this system operates, and how it impacts your earning potential, is crucial for navigating your career within the federal sector. The 2025 GS pay scale, built upon the foundation of the 2025 federal pay raise, seeks to address these challenges, but does it go far enough?

| GS Pay Scale Information | |

|---|---|

| Governing Body | Office of Personnel Management (OPM) |

| Legislation | Classification Act of 1923, Refined in 1949; Codified in Chapter 53, Title 5 U.S.C. |

| Coverage | Over 70% of Federal Government Employees |

| 2025 Federal Pay Raise | Average Increase of 2% (1.7% Base Pay Increase + 0.3% Locality Pay Increase) |

| 2025 Pay Cap | $195,200 (Equivalent to SES Level 4 Executive Pay) |

| Locality Pay | Adjustments to base pay based on cost of living in specific geographic areas. |

| Key Dates | GS Pay Tables are revised yearly, effective each January. |

| Calculator Link | OPM Salary Table |

The nuts and bolts of the 2025 GS pay scale reveal a multifaceted approach to compensation. The system incorporates a base pay increase, projected at 1.7% for 2025, coupled with an additional 0.3% allocated for locality pay adjustments. This locality pay is designed to bridge the gap between the base federal salary and the actual cost of living in different geographic areas. However, the Federal Salary Council's report underscores a critical issue: the disparity persists, particularly in those regions where the locality pay component is already the highest. San Francisco, New York, and Seattle serve as prime examples of this persistent challenge. This raises questions about the efficacy of the current locality pay system and whether it adequately addresses the financial pressures faced by federal employees in these expensive metropolitan areas.

- Emmas Fortune Net Worth Of Watson Chamberlain More

- The Untold Story Of Band Of Brothers Captain Sobel Fact Vs Fiction

Furthermore, the GS pay scale is structured with built-in limitations. For the upper echelons of the GS grades, a pay cap exists, pegged at $195,200 for 2025. This ceiling is dictated by the rate for Level IV of the Executive Schedule. While the base GS pay scale itself may not reach this figure, employees in the highest GS paygrades working in localities with significant cost-of-living adjustments (COLA) may find themselves bumping against this salary ceiling. This can be a point of contention for highly skilled and experienced federal employees who feel their contributions are undervalued due to these limitations.

Understanding the intricacies of locality pay is paramount for any GS employee. Earning more than the base rate pay is achieved through these locality adjustments, which are tailored to reflect the varying costs of living across the United States. The Office of Personnel Management (OPM) meticulously publishes the General Schedule base pay tables annually, typically effective each January. These revisions are intended to reflect both inflation and the increasing costs of living, ensuring that federal salaries remain competitive and allow employees to maintain a reasonable standard of living. The 2025 General Schedule (GS) Locality Pay Tables provide a detailed breakdown of these adjustments, and a data dictionary pay table is available for those seeking a deeper understanding of the structure of the XML files containing this information. This level of transparency is crucial for employees to understand how their pay is determined and to advocate for fair compensation.

The history of the GS pay scale is rooted in the Classification Act of 1923, later refined in the Classification Act of 1949. Today, the system is codified in Chapter 53, Title 5 of the United States Code (U.S.C.). This legal framework outlines the structure of the GS pay scale and designates the Office of Personnel Management (OPM) as the primary administrative body. The OPM is responsible for overseeing the implementation and management of the GS pay scale, ensuring its adherence to the law and its effectiveness in compensating federal employees fairly. The evolution of the GS pay scale reflects the changing needs of the federal workforce and the ongoing efforts to create a system that is both equitable and responsive to economic realities.

- Whos Who The Ultimate Guide To The 911 Lone Star Cast

- Brittany Ashton Holmes Now Life After Little Rascals Revealed

The annual federal pay raise process is a multi-stage endeavor, commencing with proposals from the executive branch. In March, the Biden administration proposed a 2% federal pay raise for 2025. This initial proposal is merely the starting point, subject to further debate and negotiation within Congress. The final outcome of this process will determine the actual pay adjustments for GS employees in 2025. Staying informed about the progress of the annual federal pay raise is essential for all federal employees, as it directly impacts their financial well-being. Various resources are available to track these developments, including government websites, news outlets, and professional organizations representing federal employees.

Navigating the GS pay scale can be daunting, but tools like the General Schedule Salary Calculator can simplify the process. These calculators allow employees to determine their precise salary based on their location, GS grade, and GS step. By inputting these variables, employees can gain a clear understanding of their current earnings and potential future earnings within the GS system. These calculators also provide valuable insights into the impact of locality pay adjustments and step increases on overall compensation. The ability to accurately calculate one's salary empowers employees to make informed decisions about their career advancement and financial planning.

The GS pay scale is just one of many pay systems within the federal government. Other systems include the Federal Wage System (FWS) for trades and labor occupations, the Law Enforcement Officer (LEO) pay scale for law enforcement personnel, and the Executive Schedule for senior government officials. Each of these pay systems has its own unique structure and criteria for determining compensation. Understanding the differences between these systems is important for those considering a career in federal service, as it allows them to make informed choices about the type of position that best aligns with their skills and financial goals.

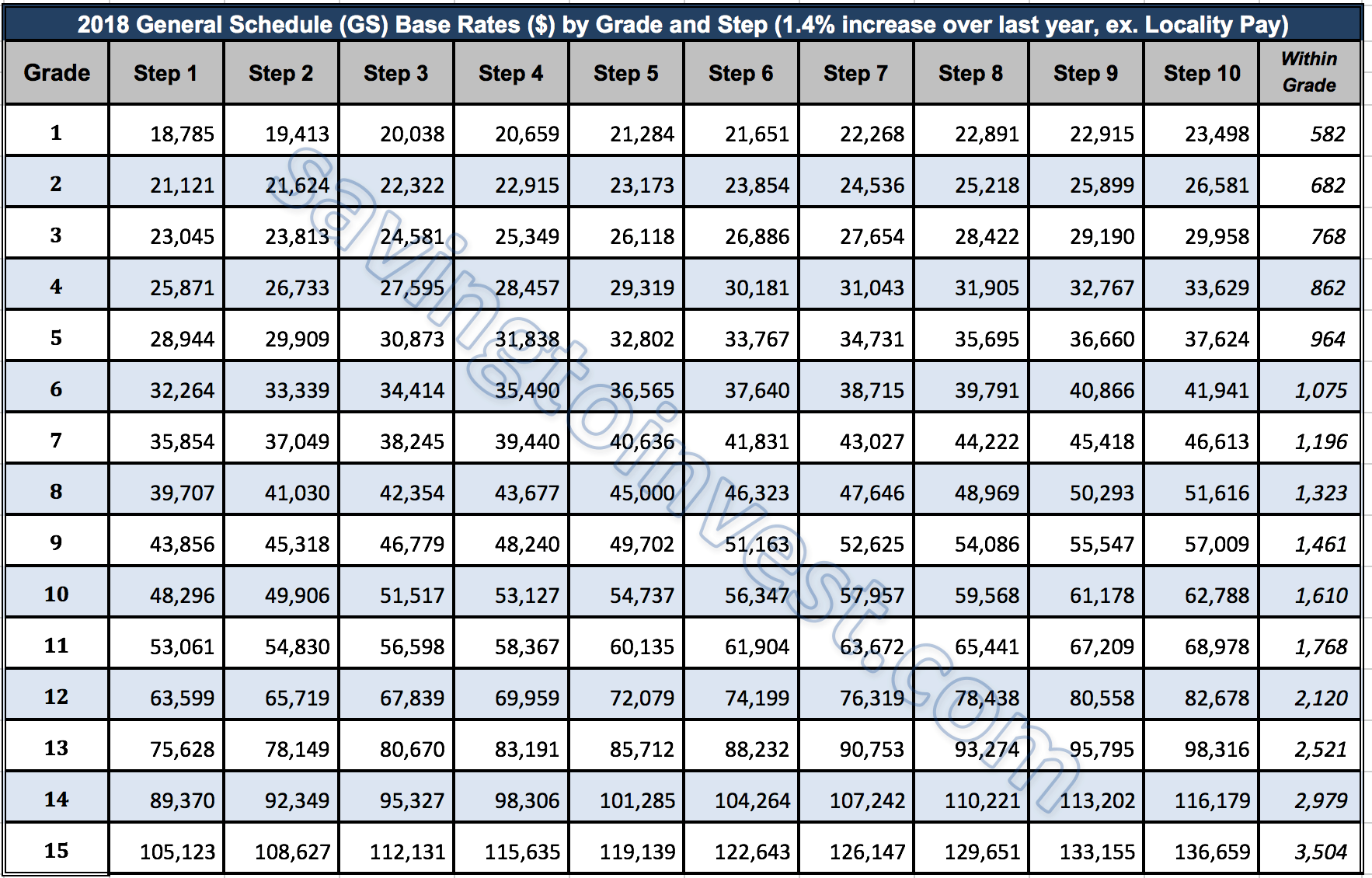

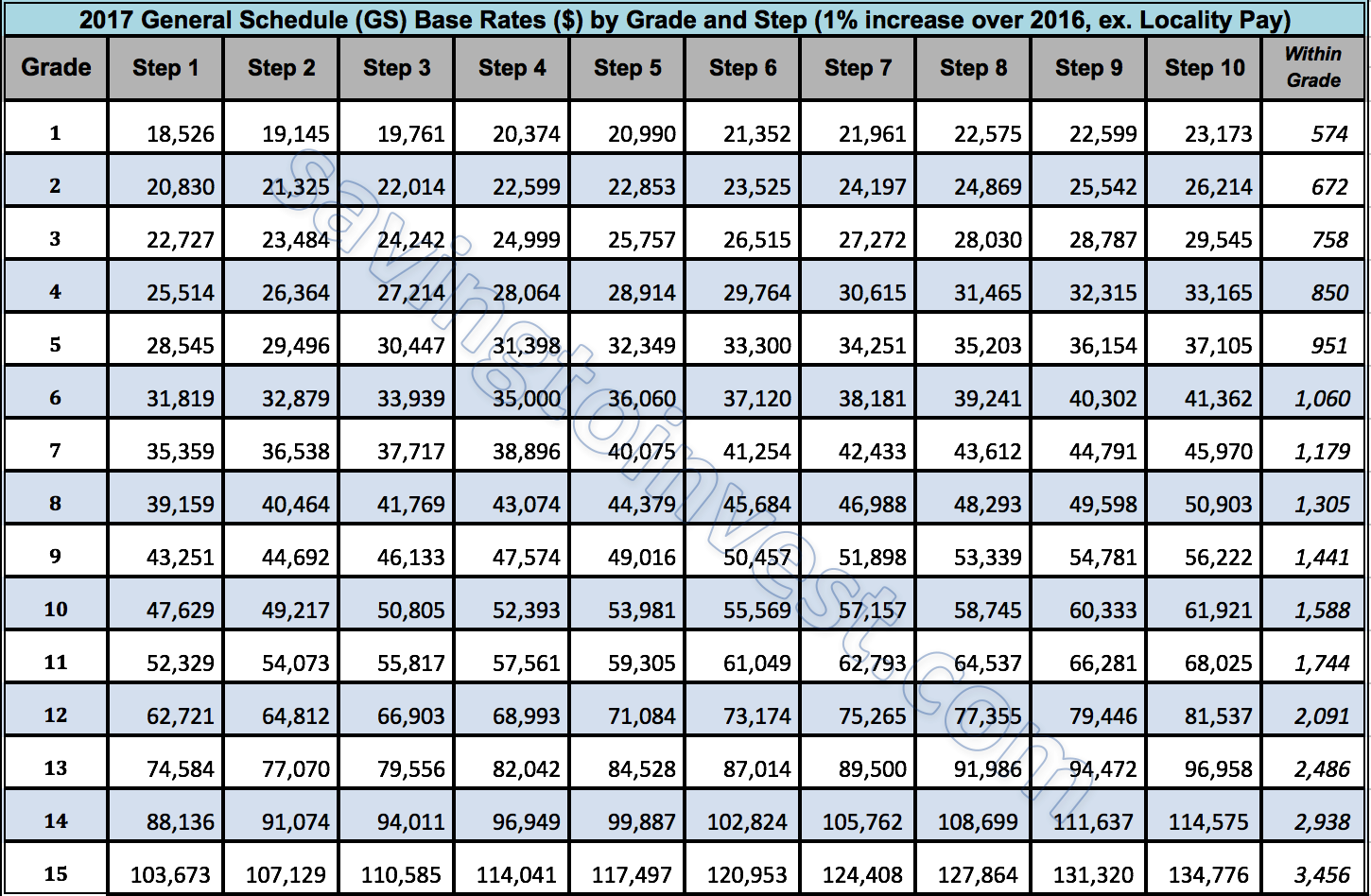

A GS pay grade represents a specific rate of basic pay, determined by the level of work, range of difficulty, responsibility, and qualifications associated with a particular position. The GS system comprises 15 grades, from GS-1 (entry-level positions) to GS-15 (highly specialized and supervisory roles). Each grade is further divided into 10 steps, with employees typically advancing through the steps as they gain experience and demonstrate proficiency. The combination of grade and step determines an employee's base salary, which is then further adjusted by locality pay, if applicable. The GS pay grade system provides a structured framework for classifying positions and ensuring that employees are compensated fairly based on the complexity and demands of their work.

Resources are readily available to assist federal employees in understanding and navigating the GS pay scale. The Office of Personnel Management (OPM) website provides comprehensive information on the GS pay system, including base pay tables, locality pay tables, and guidance on various pay-related issues. Additionally, numerous websites and organizations offer salary calculators, articles, and other resources to help employees understand their pay and benefits. By taking advantage of these resources, federal employees can empower themselves to make informed decisions about their careers and financial futures.

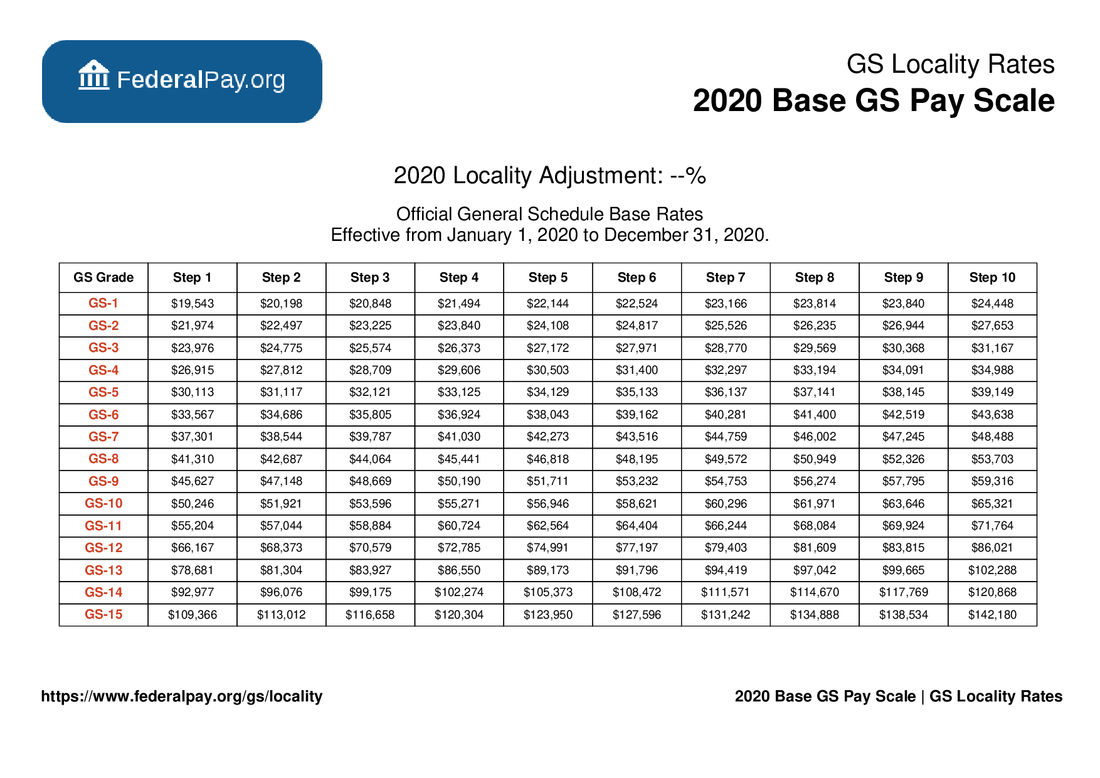

In 2024, federal employees could find annual and hourly rates for the General Schedule (GS) pay system. Base pay tables and locality pay tables for different geographic areas are also accessible. For 2025, finding base pay rates and locality adjustments for federal civilian employees in the General Schedule (GS) payscale is crucial. Pay tables and related materials for the General Schedule (GS), Law Enforcement Officer (LEO), Federal Wage System (FWS), and other pay programs are vital for understanding federal compensation structures. Users can search by year or use the salary calculator to compare rates and localities. Finding the annual rates by grade and step for the General Schedule (GS) pay system effective January 2025 aids in understanding pay progression. Tables showing base pay for each step and the WGI (locality pay) for WGI 1 and WGI 2 provide detailed pay information. Base rate, locality pay, and step rates for General Schedule (GS) pay grades in 2024 are also important for comparison.

The General Schedule (GS) payscale is a cornerstone of the federal government, impacting the financial lives of countless public servants. Understanding its complexities, from base pay rates to locality adjustments, is essential for navigating a career within the federal sector. As the 2025 GS pay scale takes effect, federal employees should leverage the available resources to ensure they are being compensated fairly for their contributions to the nation.

- Leo Virgo Cusp Are You One Traits Compatibility More

- Mr Miyagis Untold Story The Life Legacy Of Pat Morita

Gs Pay Scale 2025 Dc Locality Schedule Ian M. Gunter

Gs Pay Scale 2025 Dc Locality Schedule Ian M. Gunter

General Schedule (GS) Base Pay Scale for 2020